Domestic politics in the U.S. can have enormous ramifications for the rest of the world. In a letter, the Treasury Secretary, Janet Yellen, warned Congress that the U.S. government might be unable to pay the bills in just over a week — as early as 1 June — if Congress does not act to raise or suspend the debt ceiling. If, indeed, the United States defaults on its federal debt and the crisis isn’t resolved, ‘no corner of the global economy will be spared.’

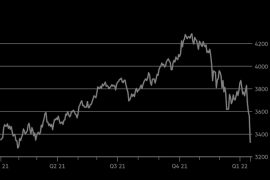

Economists at Moody’s estimate that even if the debt limit was breached for a week, ‘the U.S. economy would weaken so much, so fast, as to wipe out roughly 1.5 million jobs.’ If the U.S. government defaults were to last longer, ‘the consequences will be more dire.’ The U.S. economic growth would plummet, more than 7.8 million Americans would lose their jobs, borrowing rates would rise up, the unemployment rate would soar from the current 3.4 per cent to 8 per cent, and a stock market plunge would erase $10 trillion in household wealth.

This would lead to an economic recession in the United States which, in turn, would reverberate across the world.

What Is Debt Ceiling?

Every year, the American government spends more than it collects in taxes. To match the deficit, investors have, for years, lent money to the United States government by buying treasury bonds because they are confident that the United States always pays its debts.

Under U.S. law, Congress must periodically raise the country’s debt limit, or the government won’t have enough money to pay its debt obligations, such as interest on bonds, delivery cheques to contractors and soldiers, and social security recipients.

Contrary to public perception, raising the debt limit does not authorise new spending. It simply allows the U.S. government to borrow enough to pay the bills Congress has already approved.

Historically, the United States has avoided a debt default crisis by increasing or suspending the debt ceiling an estimated eighty times since 1960. However, the risk of a U.S. government debt default looks higher this time.

America’s political class blame one another for the situation. For instance, Kevin McCarthy, the Speaker of the House, blames the United States President Jo Biden for ‘ignoring the problem’ and ‘spending too much – almost $6 trillion.’ Blaming Biden, he said:

Each year, discretionary, year after year, he [Biden] spent nearly 40 billion extra dollars, and it is very hard to get off the spending spree that they are addicted to.

The Republicans say they would raise the debt ceiling only if President Biden and the Democrats agree to spending cuts. Interestingly, the Republicans did not make such demands or hesitate to raise the debt limit when Donald Trump, a Republican, was the President.

However, post-COVID, as Trump and Biden spent heavily to support the American economy, the Federal government debt has ballooned to unsustainable levels. In January 2023, the U.S. government reached a debt limit of $38.3 trillion. Given that the Democrats and the Republicans are unable to resolve their differences and raise the debt limit before 1 June 2023, the risk of debt default looms large.

What happens if the U.S. is unable to pay its debt?

“A debt default would be a cataclysmic event, with an unpredictable but probably dramatic fallout on U.S. and global financial markets,” said Eswar Prasad, professor of trade policy at Cornell University and senior fellow at the Brookings Institution, according to AP.

As the world’s financial activity is based on the confidence that America will always meet its financial obligations, U.S. debt was viewed as an ultra-safe asset. It was and is the foundation of global commerce, built on decades of trust that the United States would always meet its financial obligations.

Much of the world’s economic activity is pegged to the U.S. dollar. For instance, from 1999 to 2019, 96 per cent of trade in the Americas was invoiced in U.S. dollars; over 79 per cent of European trade and 74 per cent of trade in Asia took place in dollars, according to researchers at the U.S. Federal Reserve.

Furthermore, most of the world’s central banks stockpile dollars. According to the IMF, U.S. dollars account for 58 per cent of all the foreign exchange reserves held by the world’s central banks, followed by the Euro, an estimated 20 per cent, and the Yuan, an estimated 3 per cent.

A default could shatter the $24 trillion market for Treasury debt, cause financial markets to freeze and ignite a catastrophic global financial crisis. Imports and exports would collapse. “Without (dollars), we can’t do any transaction,” said Nihal Seneviratne, Essential Food Importers and Traders Association spokesman. “When we import, we have to use hard currency — mostly the U.S. dollars,” he says, speaking to the AP.

Though the U.S. dollar has remained a dominant currency globally, a debt default would lead to an accelerated erosion of trust in the stability of the U.S. economy. The United States’ reputation will be damaged, and other currencies – such as the Euro and, to a lesser extent, the Chinese Yuan – will gain greater legitimacy. This, in turn, could accelerate ‘de-dollarisation’ of the world. Given that a rising dollar can trigger crises, the United States’ clout to use the dollar to impose financial sanctions against rivals and adversaries will also take a beating.

As excessive dependence on the dollar could potentially derail the global economy, it is time for nations across the world to think how they can protect themselves from falling victim to U.S. led global financial catastrophes,

-30-

Copyright©Madras Courier, All Rights Reserved. You may share using our article tools. Please don't cut articles from madrascourier.com and redistribute by email, post to the web, mobile phone or social media.Please send in your feed back and comments to [email protected]