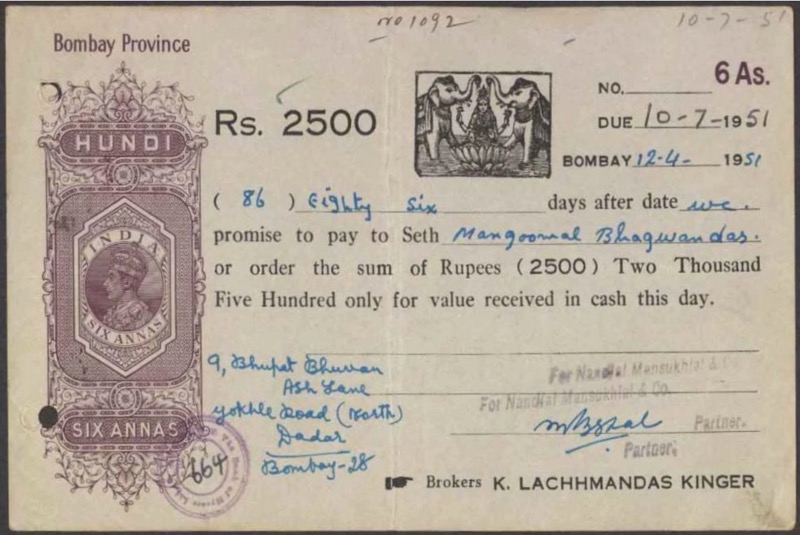

Ancient Indians – together with the Chinese and Lydians of the Middle East – were the world’s first people to issue coins. Indian coins can be traced back to the sixth century BC; until the eighteenth century, coins were the only form of payment. However, for long-distance transactions, trust networks drove a system of hundis or bills of exchange.

A Hundi is a written unconditional order by a person commanding another to pay a certain amount of money to a person listed in the order. They were used as a substitute for cheques issued by indigenous bankers. They have no legal standing since they are part of an informal system. The paper currency did not play a role in India’s economy until the British East India Company expanded their trading endeavours in India.

The unstable economic conditions in North India under the British administration of Bengal in the 1760s initiated the concept of paper money. The British East India Company’s expansionist strategies had resulted in a scarcity of gold and silver bullion in Bengal, producing a potential credit crisis—the introduction of paper money was meant to secure payments to the company personnel in far-flung areas.

Private banks such as the Bank of Hindostan (1770-1832), the General Bank in Bengal and Bahar (1773-75, founded by Warren Hastings), and the Bengal Bank (1784-91), among others, produced the first notes of the country. The Bank of Bengal issued India’s first known currency note towards the end of the eighteenth century.

The British East India Company did not recognise the banknotes legally; hence, the distribution was limited. Even until 1832, when three of these banks failed because of financial mismanagement, they only acted as private promissory notes.

The British East India Company was in a financial pickle as the banks failed. They needed funding for the wars they were waging against local rulers like Tipu Sultan. For that reason, semi-government banks were introduced into the system.

The Bank of Calcutta, subsequently known as the Bank of Bengal, was founded in 1806 with a government stake of 20 per cent, giving them the authority to choose three board members.

The Bank of Bengal issued notes worth one crore sicca rupees, which were far more circulated due to its status as a semi-governmental institution. The British East India Company issued the sicca rupee coins, a variant of the Indian rupee.

The term “Rupee” derives from the Sanskrit word “Rupya,” which means “formed, stamped, imprinted, or coin,” as well as the Sanskrit word “raupya,” which means “silver.” When Sher Shah Suri defeated Humayun, he struck a 178-gm silver coin and called it rupiya. The rupiya was split into 40 copper pieces known as paisa.

In 1833, the Bank of Bengal acquired the authority to make civil and military payments in all the towns and villages of the Presidency. However, the Government of British India got a monopoly on note issuance only after the Paper Currency Act of 1861 was enacted. Until then, note issuance was in the hands of Private and Presidency Banks.

The early notes were promissory notes that paid 10-20 per cent annual interest rather than cash. The Payee sent half a note via mail. After receiving an acknowledgement of receipt, the other half’s dispatch occurs. Both parts were presented simultaneously in return for silver rupee coins of equal value. After the exchange, the note was labelled ‘cancelled,’ and the signature was ripped to prevent misuse. The note was saved for record-keeping reasons.

A Collector’s Delight

In Rezwan Razack and Kishore Jhunjhunwalla’s The Standard Reference Guide to Indian Paper Money, the oldest surviving banknote of India, issued in 1812, makes an appearance. The collection of the first banknotes is precious today and sells for millions. In May 2018, a rare Rs 25 note from the Britannia Series was auctioned by Classical Numismatics Gallery for nine lakh rupees.

The Britannia Series notes were the final release of The Bank of Bengal. The bank produced three batches of paper currency: The Unifaced Series printed just one side of the note. The following Commerce Series had a female figure printed to represent commerce. Lastly, the Britannia Series featured a more intricate design to avoid fabrication.

In 1840, Bombay was a commercial hub of the British Presidency. The second Presidency Bank was founded to issue notes by the Bank of Bombay.

In 1843, the Bank of Madras also started issuing paper currency. Three banks dominated British India’s financial system and were in charge of producing banknotes.

After the government seized complete control of paper money-minting, the three banks were charged with handling and distributing the new currency as government bankers. The three banks merged in 1921 to become the Imperial Bank of India.

The government issued currency notes until April 1, 1935, upon establishing the Reserve Bank of India. The one rupee note was given coin status when it was revived as a wartime measure in August 1940. Until 1994, the Indian government continued to issue one-rupee notes.

-30-

Copyright©Madras Courier, All Rights Reserved. You may share using our article tools. Please don't cut articles from madrascourier.com and redistribute by email, post to the web, mobile phone or social media.Please send in your feed back and comments to editor@madrascourier.com