The British ruled India for over two hundred years. In the early years of colonial expansion in India, they experimented with several modern concepts. One of the concepts was that of a bank.

India had several lending institutions. Members of merchant communities, known as vaishyas, stood guarantees for transactions. However, the idea of a ‘bank’ as an institution was formally introduced only in the late 1700s.

The year 1770 saw the advent of the ‘banking system’ in colonial India. Alexander & Co started the first-ever Bank, the Bank of Hindostan. Some scholars suggest that the British had tried to open banks earlier, too. However, there no evidence to substantiate the claim.

We do not exactly know what led Alexander and Co. to open a bank in India. Did they establish the bank on the orders of the British officials? Or was the establishment a way to expand their banking chain across colonial India?

After they set shop in India, the East India Company started trading in commodities, like indigo, cotton, silk, etc. European traders needed banks to finance international trade. To facilitate this, the East India Company introduced agency houses in Calcutta. These houses performed all the banking functions required by the EIC. Messrs. Alexander and Co.’s agency house laid the foundation of British India’s banks.

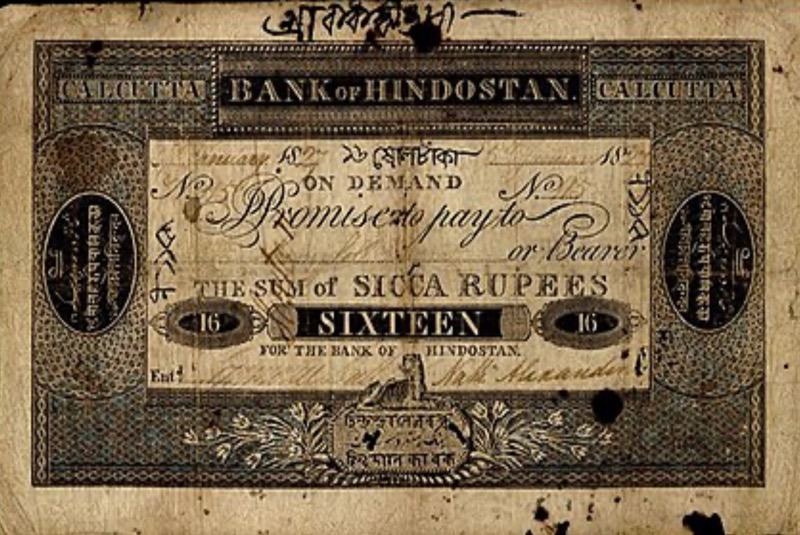

The Bank of Hindostan was a branch of Alexander and Co. It was privately owned, engaged in trading business, and didn’t deal with joint-stock principles. It was the first bank to introduce currency paper notes in India. The notes were only representational as silver and gold coins were legal tender in India. The bank held reserves of these coins, which were known as Rupiya.

A system was followed to retrieve currency paper notes. Every note contained a Promisary Clause, where the bank promised to pay the actual Rupiya to the bearer in exchange for the bank-issued paper notes. The institution was liable to pay actual money to the bearer whenever they demanded it.

The first-ever bank of India is especially famous for its sixteen rupee note, printed in 1830. The note’s design is unique: on the front of the note, the Bank of Hindostan was written in capitals in the top centre, and the denomination was written on both sides. ‘Bank of Hindostan’ is written in three different languages on the paper note: Persian, Bengali, and Hindi. The note was infamously called “Sicca Rupee Sixteen.”

Other paper notes were issued as well. Currency notes of denominations 4, 10, 20, 50, 100, 250, and 500 were printed. The highest denomination was 1000. Some of these notes were issued, while others were not. But they surely introduced a new type of currency in British India, carried forward by the subsequent established banks.

However, the introduction of this new kind of currency turned out to be problematic. The bank faced a run-on, presently called Bank Failure, three times. (A run-on is when depositors flock to the banks to withdraw their money amid fear that the bank cannot exchange the notes with actual money — gold and silver coins).

The first such panic was caused by a malicious rumour in 1819. The next instance was in 1829 due to the failure of an agency house, Palmer and Co., in Calcutta. The next panic was in 1832 because of the commercial crisis that eventually led to the closing down of various private banks. The Bank of Hindostan ensured that it had sufficient reserves of actual money. This helped the institution overcome the obstacle three times.

In 1832, the bank faced a massive commercial crisis for the agency houses in the Bengal Presidency. During the mid-1820s, there was excessive demand for indigo, which caused the prices of indigo to become highly volatile.

Around the same time, the first Anglo-Burmese war began, leading to a scarcity of metal in Calcutta. The same period saw an investment boom in Britain. The market situation had changed. And with that, interest rates had risen, making the investors even more cautious.

The market panic caused several agency houses to shut down. Messrs. Alexander & Co withdrew their banknotes from circulation, and the agency house was in debt. And so, the commercial crisis of 1832 led to the demise of the Bank of Hindostan.

The Bank of Hindostan was established over 250 years ago and was operational for about half a century. It began a uniform and fair financial structure in the Republic of India.

-30-

Copyright©Madras Courier, All Rights Reserved. You may share using our article tools. Please don't cut articles from madrascourier.com and redistribute by email, post to the web, mobile phone or social media.Please send in your feed back and comments to [email protected]